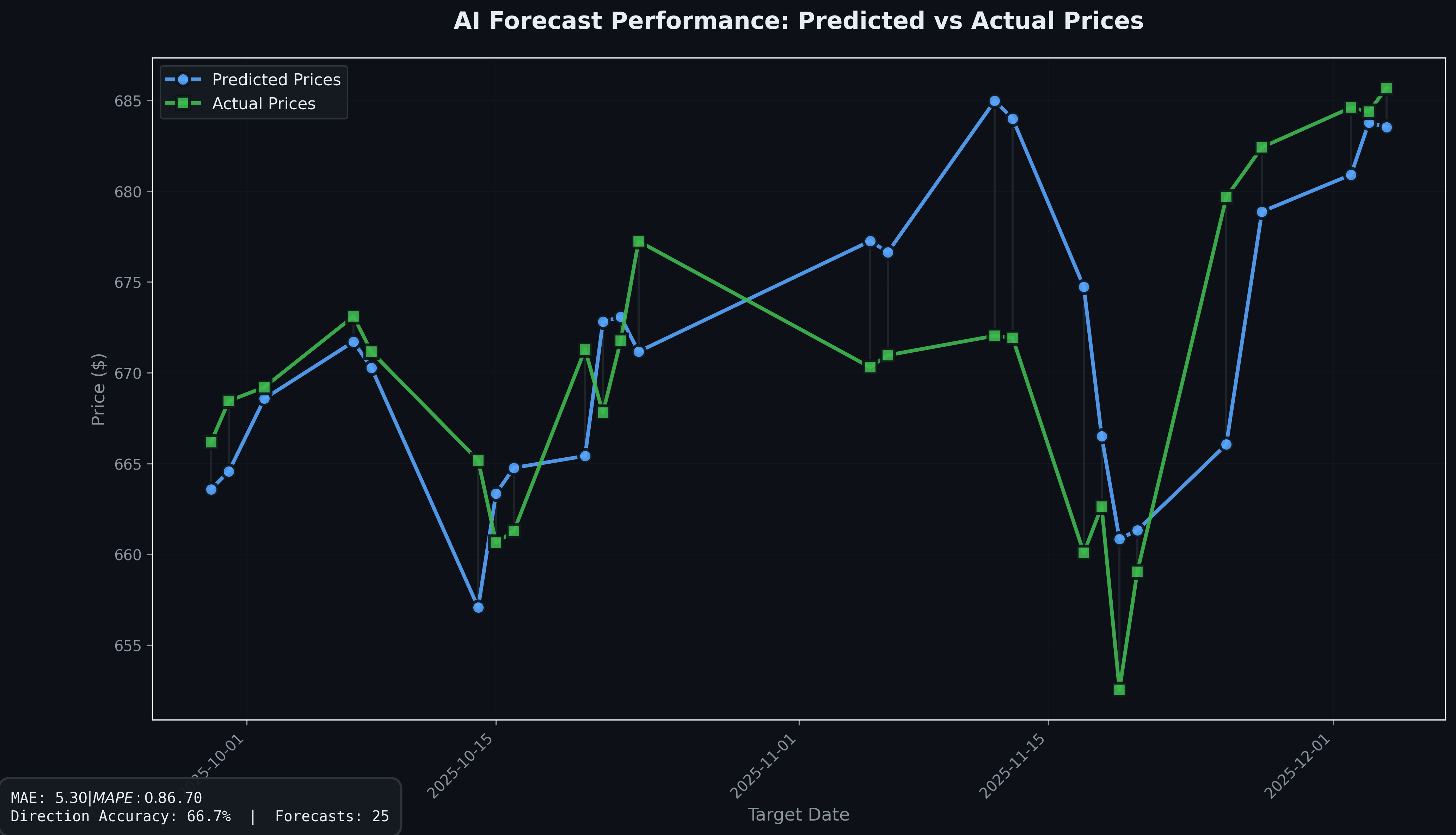

Proven Prediction Accuracy

Our AI forecasting model continuously validated against real market data

Stop guessing. Start measuring. Access real-time Gamma Exposure (GEX), Volatility Skew, and validated institutional order flow directly from your browser.

Elite features coming soon. Join the waitlist now.

💼 Passive income?

Earn 30% recurring commission promoting GEX Pro.

Learn how GEX Pro can transform your trading strategy

Our AI forecasting model continuously validated against real market data

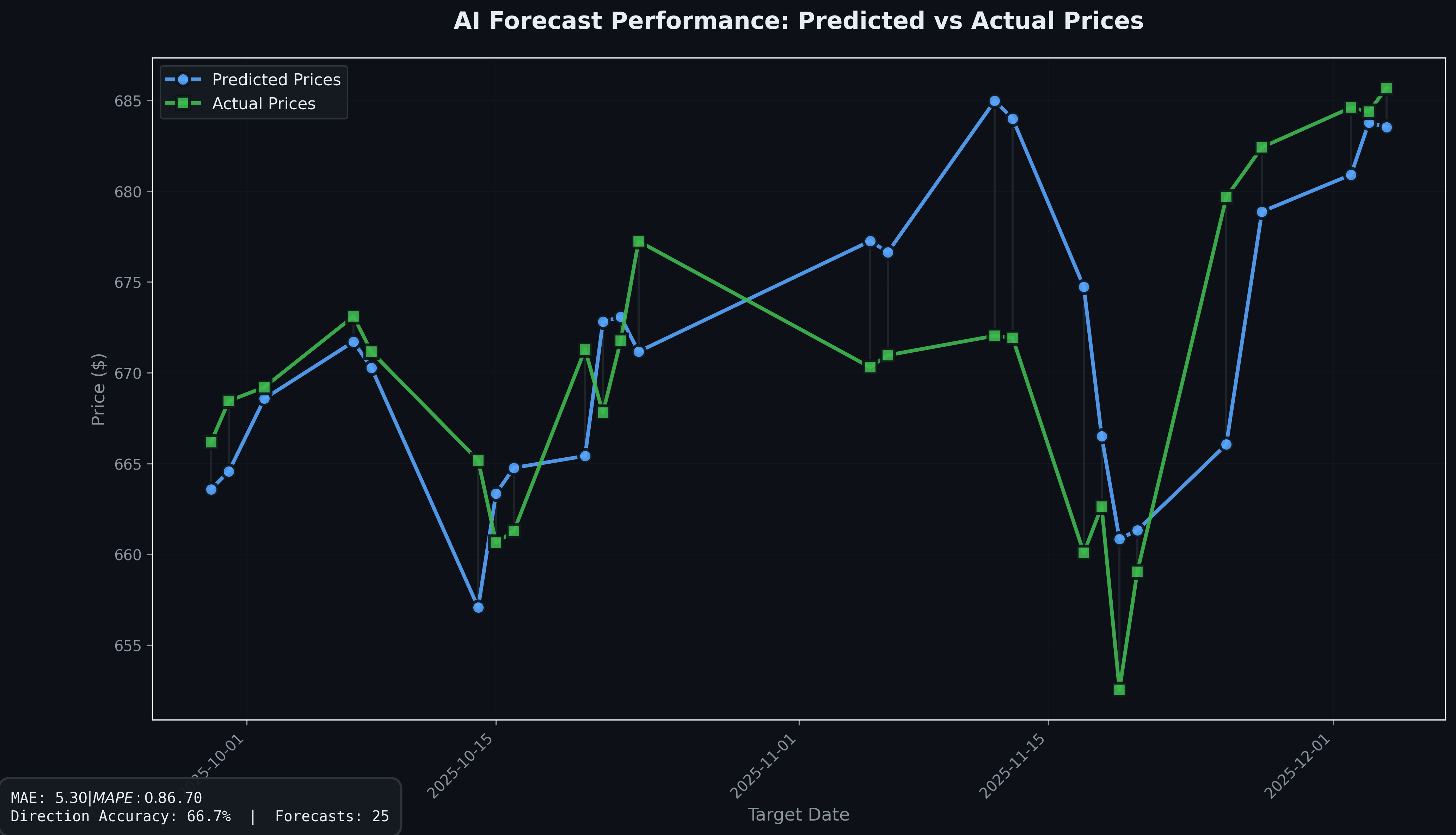

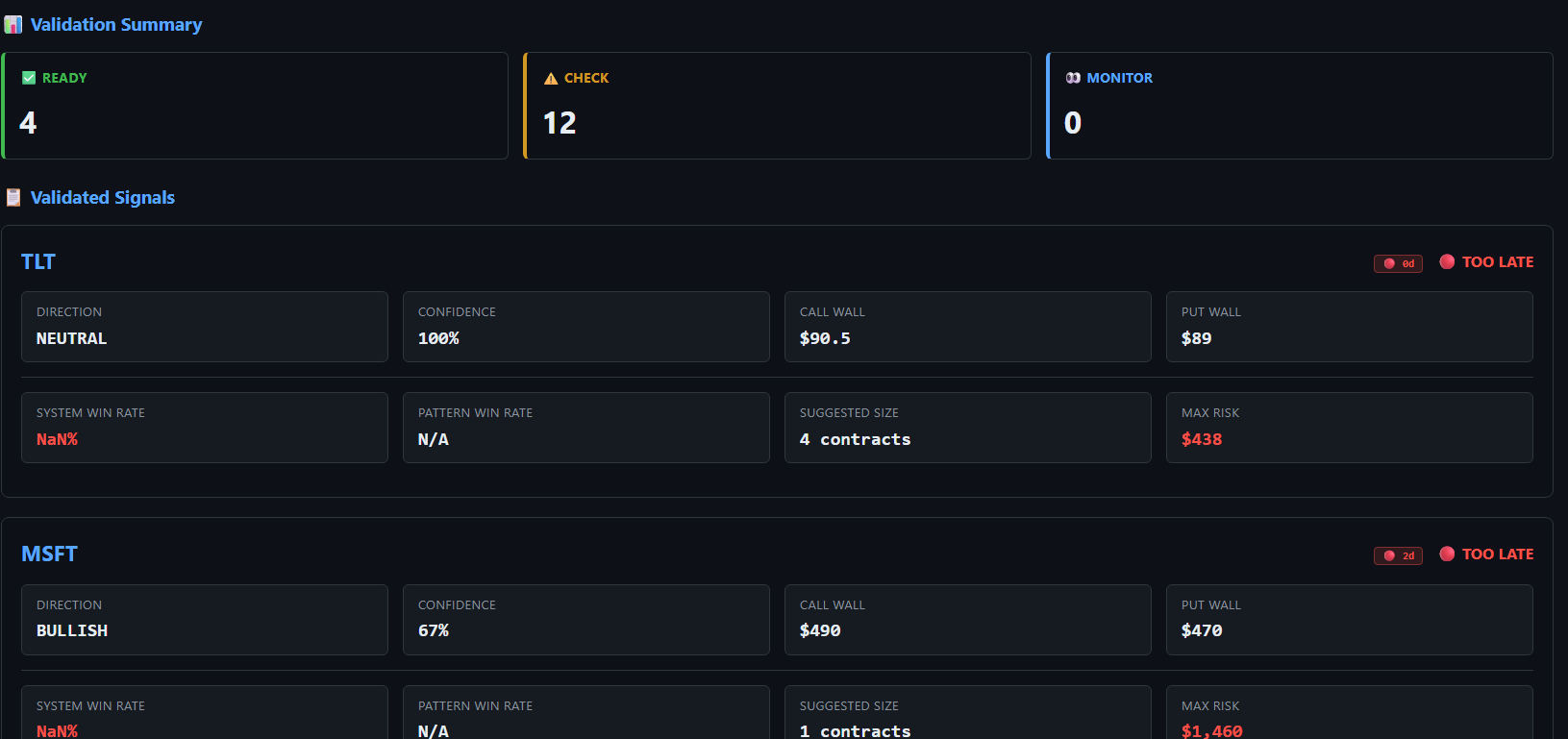

Comprehensive analysis from macro structure to trade validation.

Automated checks against system win-rates, pattern recognition, and risk/reward parameters.

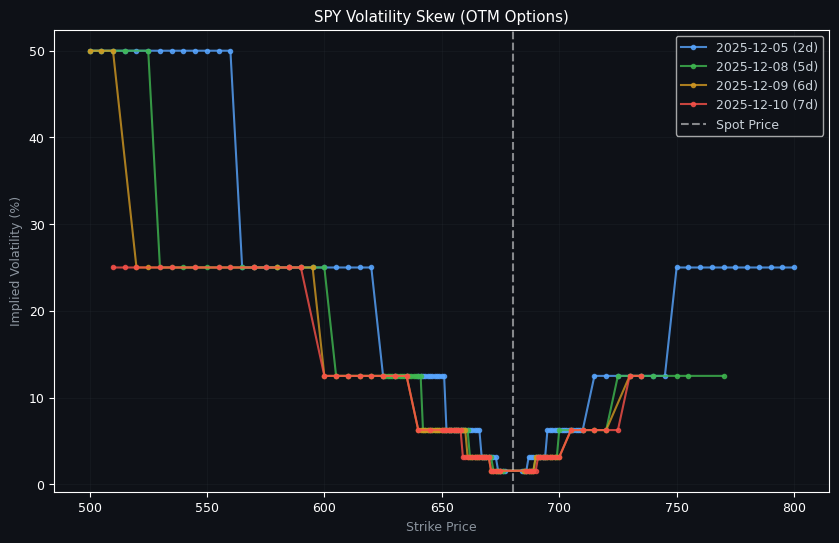

Visualize the term structure and smile to identify cheap vs expensive tails.

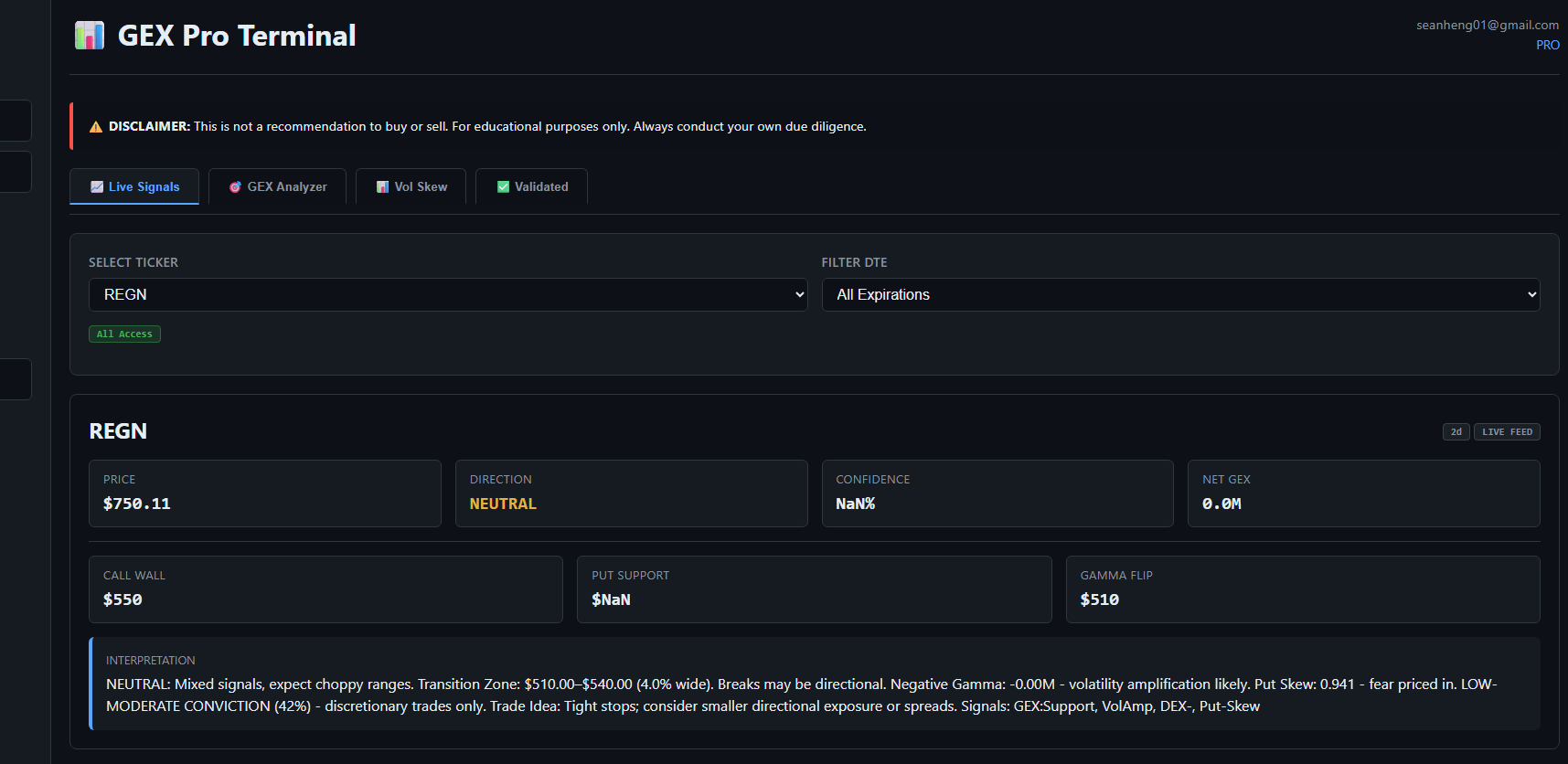

Pinpoint Gamma Flip levels, transition zones, and dealer hedging requirements.

Real-time feed of opportunities filtered by DTE, confidence, and directional bias.

Understanding the data behind the dashboard.

GEX Ratio measures the balance between positive and negative gamma exposure. A ratio above 0.5 indicates net positive gamma (potential resistance). Net GEX shows the absolute difference, revealing overall directional bias and potential hedging requirements.

Flow Ratio measures the balance between bullish and bearish options activity. Values above 0.5 indicate net bullish positioning. Net Flow quantifies the absolute difference, signalling conviction strength before price moves occur.

IV Ratio shows the normalized view of volatility differences between calls and puts. Positive Net IV suggests calls are more expensive relative to puts, often indicating bullish sentiment or supply/demand imbalances.

Real-time tracking of Max Gamma, Zero Gamma, and Min Gamma strikes. These levels act as magnets for price action, representing where dealers have the most hedging pressure.

Visualize gamma exposure and options inventory across different strike prices to identify key levels where dealer hedging activity may influence price action for optimal entry/exit.