Market Structure

Decoded.

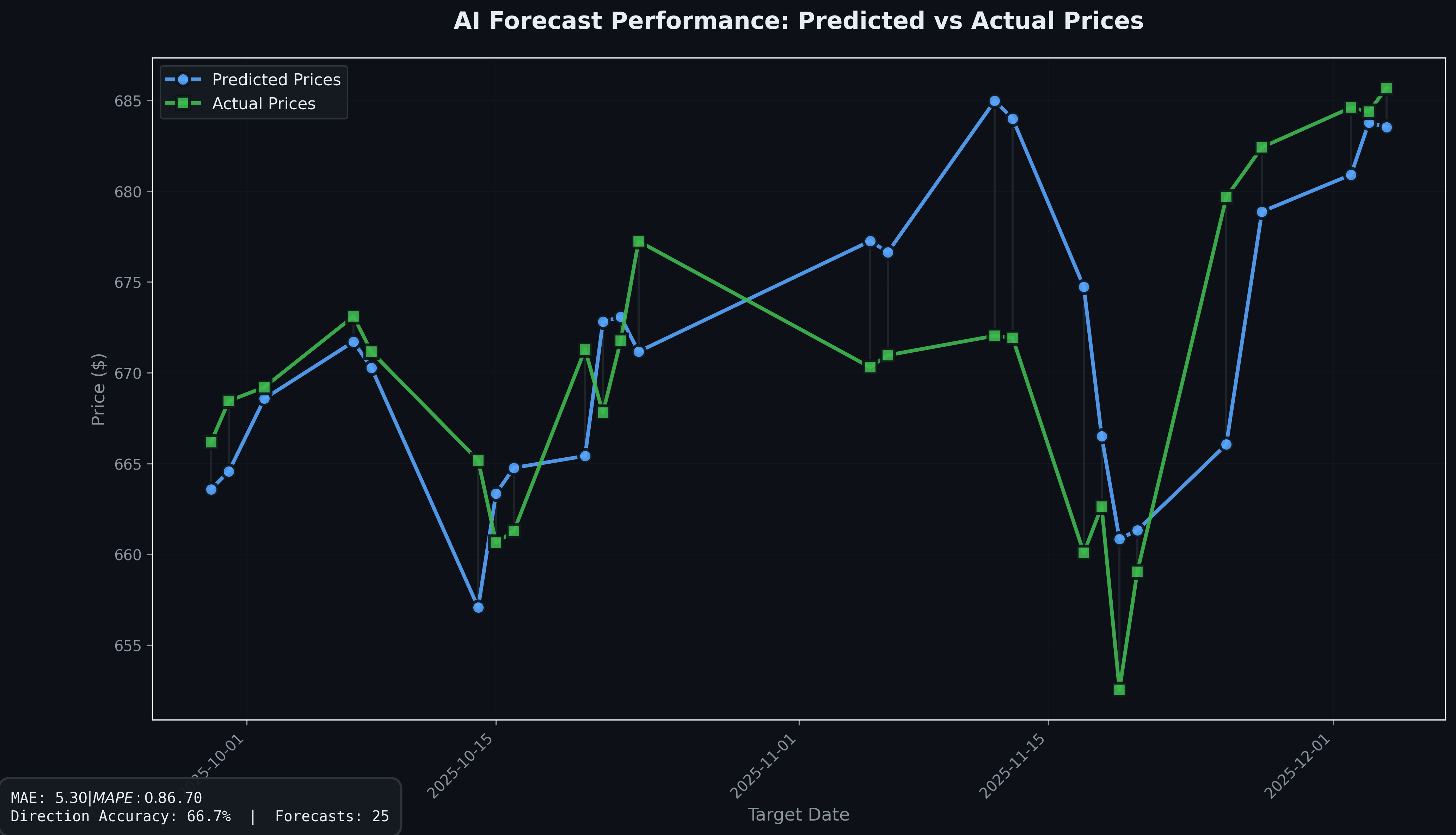

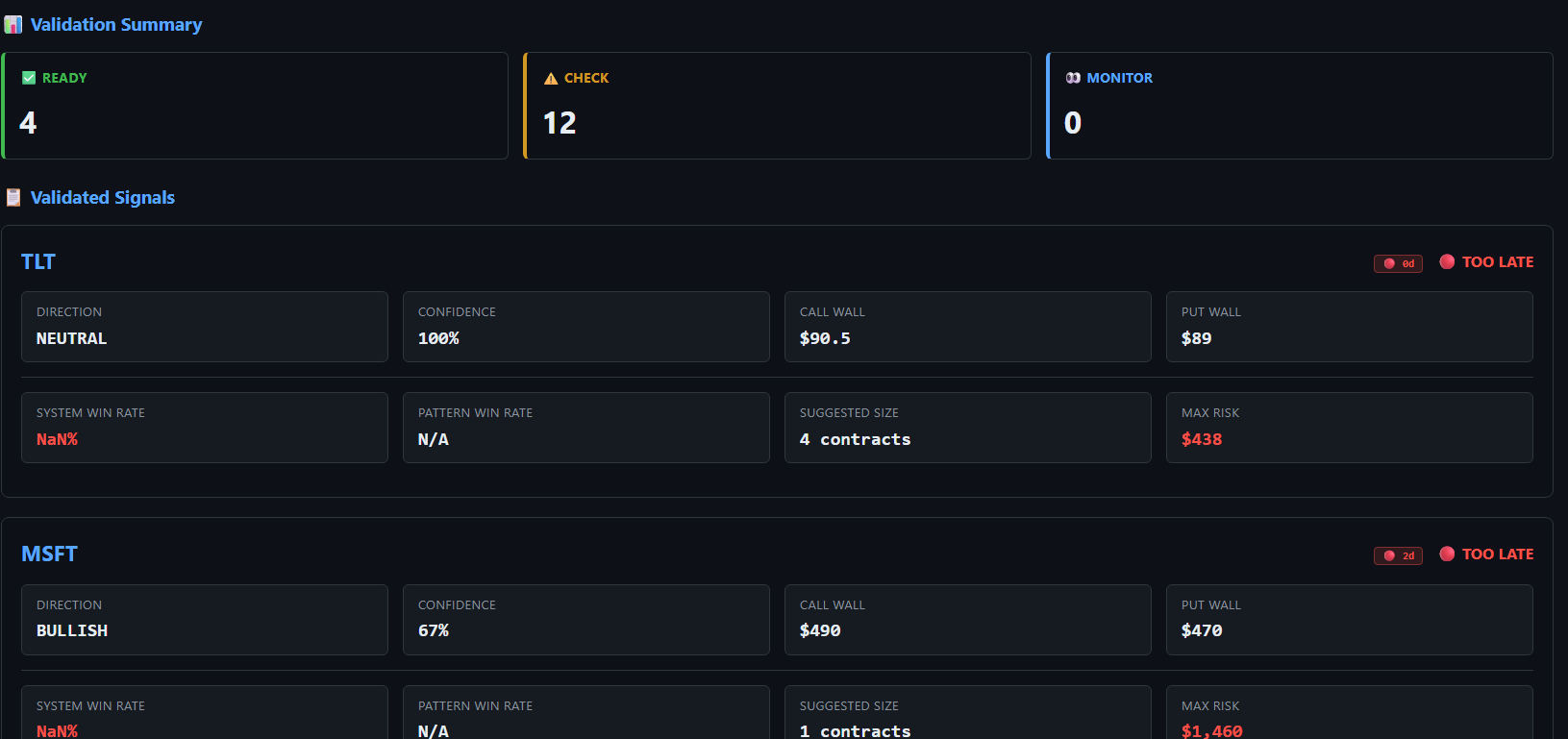

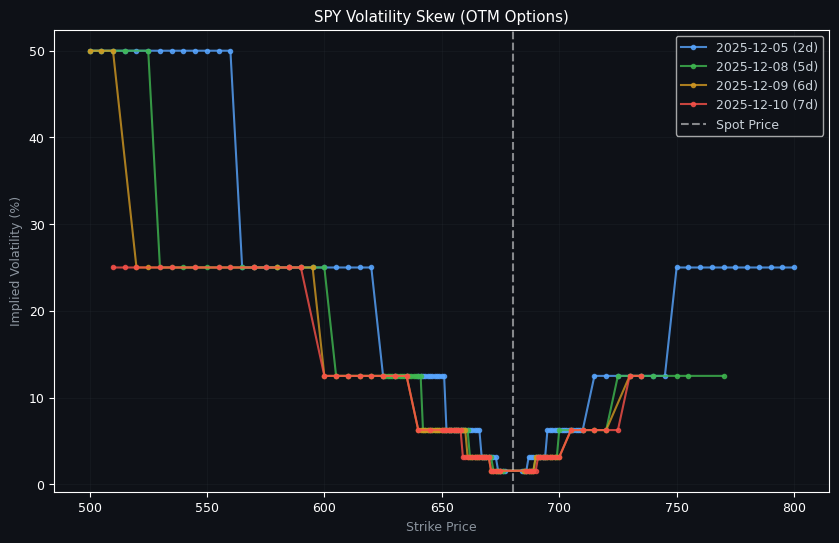

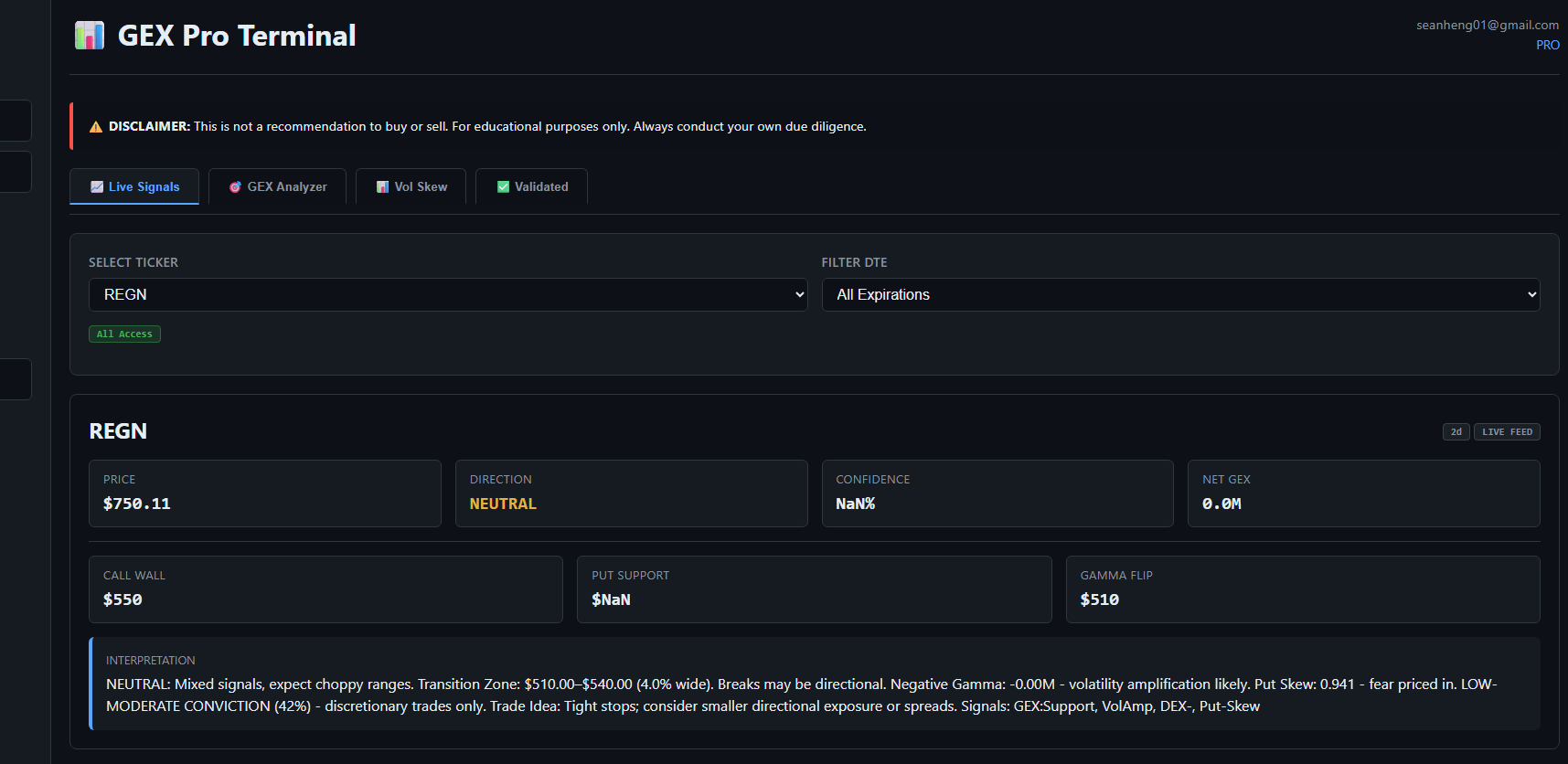

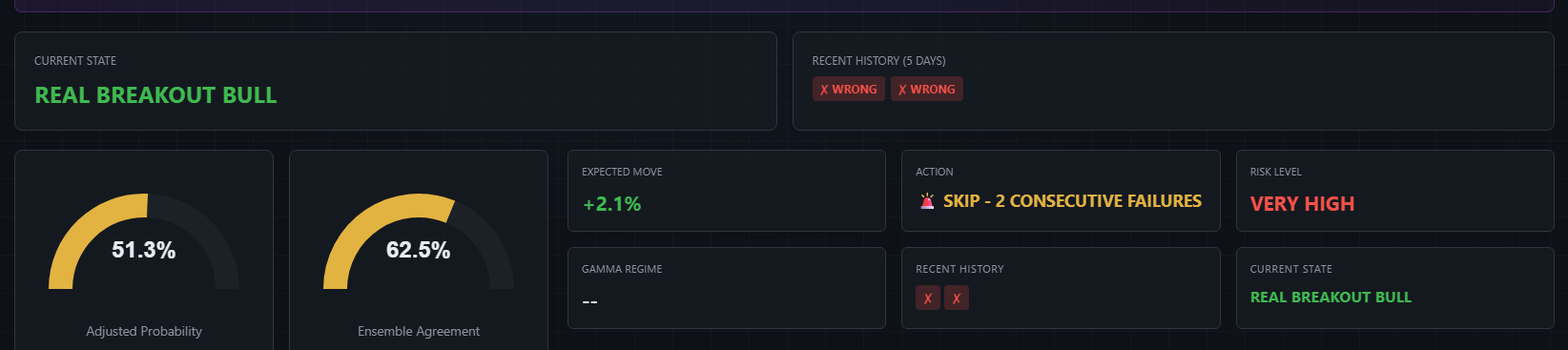

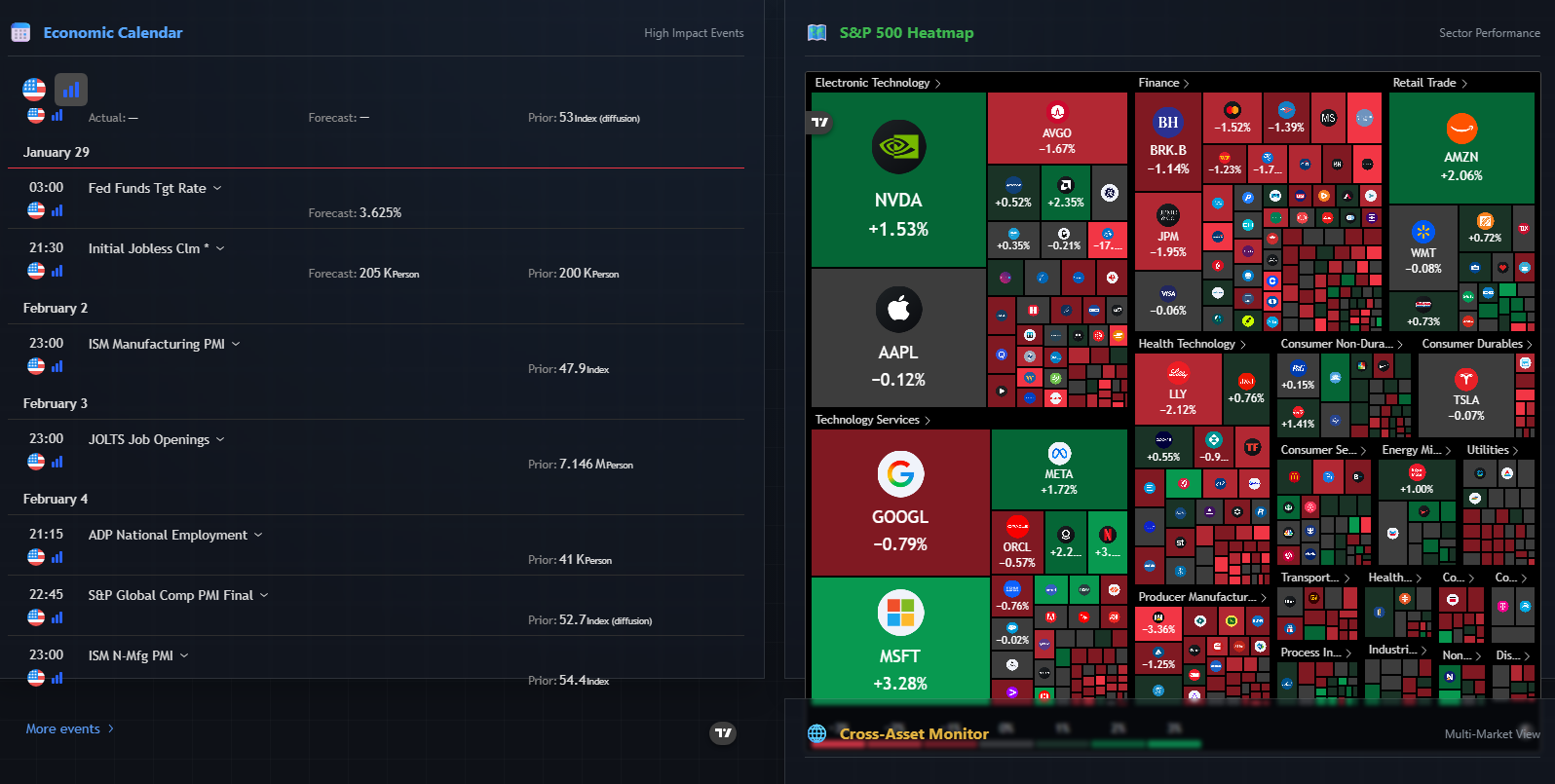

Stop guessing. Start measuring. Access real-time Gamma Exposure (GEX), Volatility Skew, and validated institutional order flow directly from your browser. AI SPY forecasts: 1% MAPE (1-2d), 1.5% MAPE (3-5d).

User Login

New account? Just enter your email to start Free Tier. Contact us to get a 14-day Pro free trial.

Need help? Contact us: